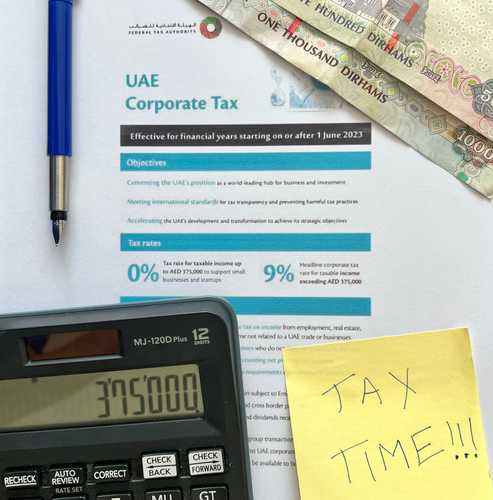

UAE Federal Corporate Tax

The UAE corporate tax changes may significantly impact your business operations. Prepare for the transition now.

Contact our corporate tax specialists and start preparing for the imposition of the new corporate tax in the UAE.

Talk to our tax specialist NOW

Taxation in UAE

What is the UAE federal corporate tax?

In the UAE, the federal corporate tax rate will be a flat rate of 9% for businesses whose taxable incomes exceed AED 375,000.

However, this blanket rate does not apply to enterprises engaged in extracting natural resources.

For such companies, the determination of corporate taxes will remain the purview of the emirate government instead of the federal government.

Tax-free

I thought the UAE is a tax-free country?

The UAE currently has no corporate tax except for emirate level corporate tax levied on the foreign bank branches and entities engaged in extraction of natural resources.

This will change, however, on or after 1 June 2023 when the new corporate income tax regime takes effect.

under the new corporate tax regime, all the businesses (except for entities engaged in extraction of natural resources) domiciled in the UAE will be subject to 9% corporate tax if their net income exceeds AED 375,000.

UAE Free Zones

Are free zone companies exempt from the 2023 corporate tax?

At the moment, it is unclear if the new corporate tax scheme significantly affects free zone companies.

Based on early reports, free zone companies may be subject to the federal corporate tax on income earned from any business done in the UAE.

Income from offshore activities may be exempt from corporate tax.

Are there any exemptions to the UAE Federal Corporate Tax [FCT]?

Enterprises

UAE government defined the following exemptions to the 9% corporate income tax that will be implemented on or after 1 June in the UAE.

The proposed FCT regime is expected to apply to all business (ie, commercial, industrial, and professional) activities in the UAE, except for the extraction of natural resources, which is already (and will remain) subject to taxation at an Emirate-level.

Dividends and capital gains earned by a UAE business from its qualifying shareholdings i.e an ownership interest in a UAE or foreign company that meets certain conditions to be specified in the UAE FCT law.

Qualifying intra-group transactions and reorganisations subject to certain conditions to be specified in the UAE FCT law.

Foreign entities and individuals who do not conduct a trade or business in the UAE on an ongoing or regular basis

Foreign investors' income from dividends, capital gains, interest, royalties, and other investment returns.

Individuals

Employment income

Unless the income comes from freelancing or from being engaged in business, commercial, professional or any other economic activities that must be licensed or must have a permit.

Income from real estate investments

As long as such investments are made in a personal capacity and not as a business that requires a commercial license.

Income, capital gains and dividends

From personal investments in shares and securities and Real Estate Investment Trusts are typically organised as ‘flow-through’ limited partnerships thus exempt from FCT.

Income & interest earned from savings accounts

Public and regulated private social security and retirement pension funds, charities and other public benefit from organisations will not be taxed by FCT.

The UAE corporate tax changes may significantly impact your business operations. Prepare for the transition now by consulting a tax consulting company. UAE businesses would do well to talk to their corporate tax accountant so they can initiate a comprehensive federal tax authority or FTA audit.

We can help. Talk to our corporate tax specialists now and start preparing for the imposition of the new corporate tax in the UAE.

Talk to our tax specialist NOWExpertise

Trust us

Our expertise and experience in international tax allows us to work with a diverse range of companies across multiple industries. This gives us a very high level of customer understanding and agility - differentiating our service.

Niche focus

A dedicated focus on our clients to deliver complete satisfaction.

Advanced service quality

Fast and accurate project execution by leveraging the power of

Global Network

A highly qualified multicultural team based across our network of offices internationally located.

Strategic approach

Our top-tier management possesses vast expertise, coupled with a strategic, innovative, and personalised approach to propel your business forward.

Decision making

Trusted and reliable recommendations to help you make the right decisions at the right time.

Contact

Contact Us Today

Still have misconceptions about Corporate Tax in UAE?

Do you know how to leverage payroll for profit?

Our certified accountants are qualified to have your best business interests in mind.